If you tapped your 401(k) during COVID, you’re not alone. At least two million Americans had to dig into retirement funds to stay afloat during the global pandemic.

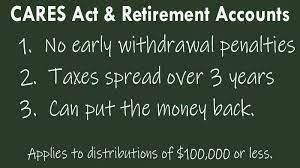

The Cares Act enabled people to draw on their retirement funds without incurring early withdrawal tax penalties. If you had to tap your 401(k) to cover expenses, there are several ways to recoup your losses quickly with saving strategies and increased contributions.

Most people tap their retirement account as a last resort. But, if you’re able to start saving for retirement again, here are four simple ways to bounce back and recover from financial loss.

Table of Contents

1. Keep calm

If you’ve drained your last asset and you’re now staring at an empty account, don’t panic.

Here’s the good news:

If you qualified for an early withdrawal from your 401(k) due to COVID, you don’t have to repay it all at once. This applies even if you withdrew the $100,000 maximum allowed per person by the Cares Act.

When you take a distribution for coronavirus-related reasons, you have up to three years to pay it back into your 401(k). According to retirement account specialists, you can spread out any tax you owe over three years.

People who pay back the entire amount they withdrew within three years can also file an amended tax return. This is one of the best methods to fully recoup your 401(k) losses since filing an amended tax return means you should receive the amount you paid back in taxes.

Secondly, you aren’t required to repay a COVID-related withdrawal. However, according to the experts, you’ll save yourself a lot of trouble by replenishing your retirement account in two ways.

- Avoid related taxes.

- Rebuild your retirement account for future growth.

The Cares Act not only made it much easier for people to take money out of retirement accounts and removed the specter of tax penalties, but it also allowed people to borrow against their vested balance.

Another way that you might have tapped into your 401(k) is through a retirement plan loan.

You’ll usually have up to five years to repay any funds borrowed against your retirement account.

The rules can get a little tricky, so you’ll want to pay close attention to the details to make sure that you don’t incur any penalties.

Here are some things to keep in mind if you took a plan loan:

- Although you typically have five years to pay it back, you will need to follow the plan’s stated repayment schedule.

- If you fail to repay the loan, you will default.

- If you’re in default, any loan balance you still owe is considered a withdrawal.

- Once your defaulted loan is regarded as a distribution, taxes and possible penalties will apply.

If you’re struggling with a retirement loan repayment, get in touch with your lender to ask about payment schedule options right away.

2. Plan your strategy

If you’re one of the millions of Americans who had to draw on your retirement savings, it’s not too late to get back on track.

It’s difficult to see a future if you’re in the middle of a crisis. Putting a roof over your head, food on the table, and avoiding high-interest credit card debt should be your priority. But if you’re ready and able to start putting money away, here are some ways to start saving for the future again.

The good news is that you have more repayment flexibility and time to develop a strategy if you take a coronavirus-related withdrawal.

If you choose a plan loan, you’d need to stick with the loan terms. However, even in this case, some strategies can still help.

Mortgage refinancing is one way to free up extra cash

Since interest rates are currently low, consider refinancing to see if you qualify to save a few hundred dollars per month on your mortgage. Every little bit helps. You can use any saved funds to put towards your retirement repayments.

Sometimes, refinancing isn’t an option, or you’re looking for other ways to free up extra funds.

Check out a home equity line of credit

With low-interest rates and a more extended period for repayment (often at least ten years), home equity credit can help you repay your COVID-distribution in 3 years to avoid taxes. It can also help you pay back plan loans faster to prevent default or associated penalties.

Take out federal student loans to cover your children’s college education instead of paying out-of-pocket

While you might ultimately want to avoid federal loans, using them while you repay and replenish your 401(k) might make sense. Freeing up this kind of money might even give you a lump sum to pay it back fast. Just make sure to borrow what you need to don’t get deep in debt.

Take time to reevaluate your spending and saving habits if there are legitimate areas that you can trim and cut back wherever possible to put your distribution back ASAP.

Not every type of strategy works for everyone. You might want to combine different methods to return the funds to your retirement account fast. You can read more details about the CARES Act on its website.

3. Don’t try to time the market

It’s never a good idea to time the market to trade existing funds for a more significant windfall. Even expert day-traders can find this difficult and wind up with losses if the market takes a sudden downturn.

It’s not as simple as timing. To time the market accurately, you would have to know the right moment to get out of the market and when to jump right back in.

Rather than playing this risky financial roulette, it’s better to contribute to your plan based on your overall financial strategy.

Since you don’t have to repay coronavirus-related withdrawals in a strict timeframe, focus on saving as much as possible to repay the amount in a lump sum.

You can also repay it at regular intervals. Just make sure that you repay the total amount within three years to skip any tax penalties.

The idea is to repay the money as quickly as possible. This will help you take advantage of the Cares Act benefit and start growing your savings again.

If you aren’t at the same employer anymore, you can also roll over the contributions into another eligible retirement plan.

4. Boost your future contributions

If you’re earning a steady paycheck and back on stable financial footing, increasing your contributions is a great way to bounce back and refill your 401(k).

When you take an early withdrawal, this can have a negative compounding impact on your retirement assets in the future.

To counteract this negative effect, it’s wise to increase your contributions as much as you can once you’re employed and have established a cash flow again. You also have the option to open another retirement account, such as a Roth IRA, if your employer doesn’t offer a 401(k).

Take advantage of any matching contributions that your employer might offer. By combining increased deductions from your paycheck with your employer’s match, your retirement fund will grow much faster.

If you’re looking to bounce back after tapping your 401(k) during COVID, there are ways to rebuild your fund. By keeping calm, knowing your repayment timeframes, developing a pay-back strategy, and increasing plan contributions will help your account recover and grow in the future.